|

Insurance, Ain't it Great?

Bob W. Deason D.D.S., P.A.

In a recent article by Dr. Robert Doty for the Dental Cyberweb a list of insurance concerns and problems was presented. These were some of the most common problems that all of us as dentists face when treating patients that have dental insurance. I hear these same problems voiced just about every time the topic of insurance comes up during a discussion with other dentists or office staff.

Although we hear the same problems and concerns we rarely hear any constructive ideas or solutions to these problems and concerns. This article was written to address some of these problems and to offer some solutions that have been developed by me and my staff over a period of twenty years in dealing with insurance companies.

I feel that in order to understand and appreciate the solutions it will be necessary to change your view of dental insurance or at least temporarily look at it from a different view. Many dentists and staff , I have found, acquire their own view of dental insurance from comments made by other people or from occurrences that may have only happened on rare occasions.

Before we go any further, let me make one point perfectly clear: I am not defending the insurance industry and I am not on the payroll of any insurance company . They still drive me up the wall every now and then. The views that I express come from my years of actually dealing with insurance companies. Some have been learned the hard way and some have been learned from other people (The easy way).

Let�s look at some facts to get a better picture of how the insurance industry has affected and is currently affecting our industry. The ADA says that in 1994 67% of all Americans had visited a dentist within the preceding two years as compared to only about 40% in the late sixties. When you consider that the growth of the population in the United States since the sixties you realize that a lot more people are seeing the dentist.

There are about 252,000,000 people in the United States of which 124,501,00 have some sort of dental insurance. So about 50% of all Americans have dental insurance.

What can we draw from these statistics? Well, for one thing, people in the United States without dental insurance DON�T GO TO THE DENTIST on a regular basis. Another way of putting it is that the people who regularly go to the dentist HAVE DENTAL INSURANCE.

It seems as if the insurance industry is responsible for getting more people into our offices. They have really done a good job of convincing the working people that dental benefits are very important . The large employers of our country have been convinced by the insurance industry that dental benefits are important to a well balanced health care plan for their employees. They have been told that unless they have a dental plan in their health care package that they won�t be able to attract the better qualified employees.

Whether or not you accept these opinions the facts seem to point out that the insurance industry has done more to get people into our offices than ALL of our "organized" efforts. In my opinion the insurance industry has become the most powerful force in the economics of our profession.

Another fact that we all must understand is that the vast majority of patients out there look for a dentist who will "work with" their insurance (read: accept the assignment). The patients that can afford to pay the entire dental fee and wait to have their insurance company reimburse them are few and far between. Even patients that could afford to pay without insurance will go out of their way to find a dentist that will work with their insurance.

Of course there will always be the offices that will not accept insurance but it is getting harder and harder to do it. When you target your services to the smallest portion of the market you must expect a very small return.

How this has happened over the last thirty years is a topic for another article, but suffice it to say that these are facts that few could deny and most of us see the results in our offices every day.

Whether the results of insurance invasion into our industry is good or bad is a topic for debate but in my opinion there are many more positive results than negative.

More patients are coming into our offices because they have dental benefits. People that don�t have dental coverage, by-in-large, don�t come to the dentist on a regular basis. These folks come in usually with an emergency condition and if the aspect of dental coverage is looming on their horizon they will put off even emergency care in many cases.

Let me pose a question to you: Would you rather have a patient come in with no insurance coverage or would you rather have a patient come in with a typical dental insurance plan ?

Many, and I have tested this with discussions with hundreds of dentists across the United States, would say "Oh, without a doubt I would much rather have a patient without insurance because then I don�t have to hassle with the insurance company."

My answer to this question would be that a patient with insurance is much more likely to have comprehensive treatment done than the patient without insurance. My choice would be the one WITH the insurance. They are the ones that have someone else HELP THEM PAY FOR YOUR SERVICES.

So there is the shift. Many dentists are like me and love it when patients come in with insurance. We see it as a way to help us deliver optimum dentistry to that patient. Optimum dentistry, you say? How about the case that you recommend a fixed bridge for the patient and the insurance company responds by saying that they will pay only the benefit for a removable partial denture. Is that the optimum for that patient ?

Good question. But let�s look at this from a different perspective. Point number one: the insurance company didn�t say that you could not do the bridge. They said that all they would pay for was the partial. You can still do the bridge, submit as a bridge and they will send you a check for the amount that they said they would send for the partial. You see we don�t have to let insurance companies dictate our treatment plans for our patients. The ideal treatment can still be done for the patient and the insurance company will help pay for it UP TO THE LIMITS OF THE POLICY. This brings us to point number two:

It is NOT the insurance company that determines the limits of coverage, it is the employer. The employer decides what limits will be in the policy when he or she buys the policy. The insurance company would love to have sold them a policy with large limits - one that would cover everything 100%. The premium for such a policy would be much larger and their profit would be much larger as well.

The final point that I would like to make with this example, and this is a very important point to understand, is that whether the patient has insurance or doesn�t have insurance, the patient has to make the SAME DECISION - do I buy the bridge or not? The patient WITH insurance has someone to HELP PAY FOR IT (remember, the insurance will still pay the amount for a partial even if you did a bridge) and the patient without insurance has to pay for the entire bridge himself. Which do you think in the real world would be more inclined to have the bridge done ? Don�t forget that if the abutment teeth needed crowns by themselves the insurance would also cover a percentage for the crowns even if you submitted for a bridge and the codes were for abutments. (In a few cases you may find that some companies will slip up on this point and not mention anything about single crowns. All they will send is the amount for the partial itself. In this case, if the abutment teeth DID need crowns anyway, you will have to CALL the dental consultant and remind them that the policy also covers crowns. In you had sent in a PTE for a partial and the single crowns you could send it back to them with the dates of services for the crowns and add a note that you actually did a fixed bridge instead of the partial. )

In Dr. Doty�s article he listed several concerns under the heading of PAPERWORK PROBLEMS. The first was contract booklets. His concern: "Contract booklets should have spelled out what exact ADA codes they cover and have a schedule of fees. Listed after the fee that they consider their scheduled 100% fee they can state at what rate they reimburse: 50%, 80%, 90% or whatever. This would eliminate all the mumbo-jumbo about UCR (they should never be allowed to use that term. That term is the most abused three words in the English insurance language). I have more patients give me more grief about that term�"

Excellent question and one that most dentists have. To adequately answer this concern we must first understand that dealing with insurance companies is like playing a game. The patient and we are on the same team. The insurance company is on another team but we are NOT PLAYING AGAINST THE INSURANCE COMPANY. We are all playing the same game but not against each other. We all play by the same set of rules made by the State Insurance Commissioner. We can win the game but for us to win doesn�t mean that the insurance company has to lose. We can win, the patient can win and even the insurance company can win. In this game there are forms of "gamesmanship", as there is in most other games. The insurance company wants to "look good" in the eyes of the patient and his employer who is paying the premium. He also wants to pay out as little as he has to and still play by the rules. That�s just good business sense. We do the same thing everyday ourselves. By setting a UCR in the policy and saying that they will cover 100% of UCR or 80% of UCR it makes the policy look better than it really is to the purchaser. When the insurance company says that our fees are higher than their "USUAL AND CUSTOMARY" it makes it seem that we are the ones to blame for the fact that the patient has to pay as much as they do. This has the effect of, in some cases, damaging the relationship between the patient and the dental office or put in another way, the insurance company has succeeded in getting teammates to start bickering between themselves and to take their eyes off the ball so to speak. This is an example of the "gamesmanship" I spoke of earlier.

Why would they want to do this? Because it can interfere with the patient continuing on with their other treatment and that would result in fewer claims being filed and fewer claims being paid . The net result being that the insurance company makes more profits. All within the rules.

Well if they can use "gamesmanship", why can�t we? Whenever we estimate what an insurance plan will cover we always estimate LOWER than the insurance company says that they will cover. As an example, if they say that they will cover 100% of a procedure we beat the insurance company to the punch and estimate that they will only cover 80% of our fee. If the patient says, "But my insurance booklet says that they will cover 100%" we respond and say, "Well, some insurance plans do actually pay 100% but we can only expect about 80% from your plan because they use outdated fee schedules and haven�t kept up with the actual fees in our area."

When we get the actual check from the insurance company we typically find that they have paid MORE than we anticipated so that we have a pleasant surprise for the patient - a credit or refund check! To which we add, "I guess your company covers better than we thought!" This is the win, win, win, situation that we described earlier. We win, the patient wins and even the insurance company wins.

Another point to add to the concern of listing their (the insurance companies�) actual UCR schedule is that if we found that our fee was LOWER than their UCR, WE WOULD NATURALLY RAISE OUR FEE. The result to them would be lower profits to them because they would have to pay a percentage of a higher fee. It is their right not to list their actual UCR schedule. We would certainly not want anyone coming into our practice and telling us how we had to do certain things and they have the same right. Its how they "set up their offense". We can set up our offense anyway we want as well as long as we all follow the rules. Whenever we have a patient express concern about an insurance company�s lack of coverage or poor coverage we respond by saying, "Mrs. Patient, your employer has selected the type of coverage that he could afford to pay for. It appears to cover basic procedures well but he has elected to minimize the coverage for complex procedures in order to keep the cost down for the policy that he has purchased for his employees. The limits and coverage amounts were actually selected by your employer when he purchased the plan. They are not decided on by the insurance company. The insurance company simply goes by the policy provisions that your employer chose."

The reason we tell them this is because the employer is NOT A DENTIST. The insurance company is perceived by the patient as another dentist. One who could decide what is the best care for them. We want to let them know that the only dentist around to decided what is best for their dental care is us.

There are several other concerns that we will address in future articles. A partial list of those concerns are: Predeterminations (PTE�s), x-ray submission, lost claims, delayed processing, PPO�s and even managed care concerns. If there are specific questions or problems that you may have I will be happy to address them. You may e-mail me directly. My e-mail address is

[email protected].

READY to JOIN?

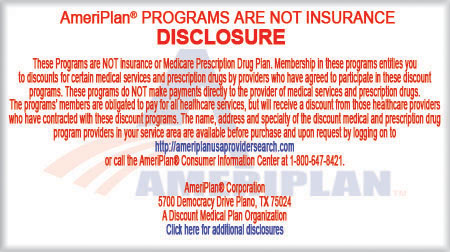

AmeriPlan�

Click to Sign-up

AmeriPlan� Broker - Work

at Home Based Business Opportunity

| |